What’s the Va IRRRL?

This new Va IRRRL, also known as new Va Interest Reduction Home mortgage refinance loan, now offers an easy provider to own experts trying to refinance its latest Virtual assistant loan during the alot more beneficial words.

Into Va IRRRL, there was reduced files (zero borrowing from the bank, earnings, or employment confirmation) and you will not need an assessment. Closing costs in addition to are straight down and certainly will end up being rolled into the loan to stop initial costs.

Va IRRRL Improve Refinance direction

When getting a beneficial Va IRRRL, specific guidance let make certain a mellow and effective refinancing techniques. Without compulsory, this type of Va IRRRL guidance are generally followed closely by loan providers:

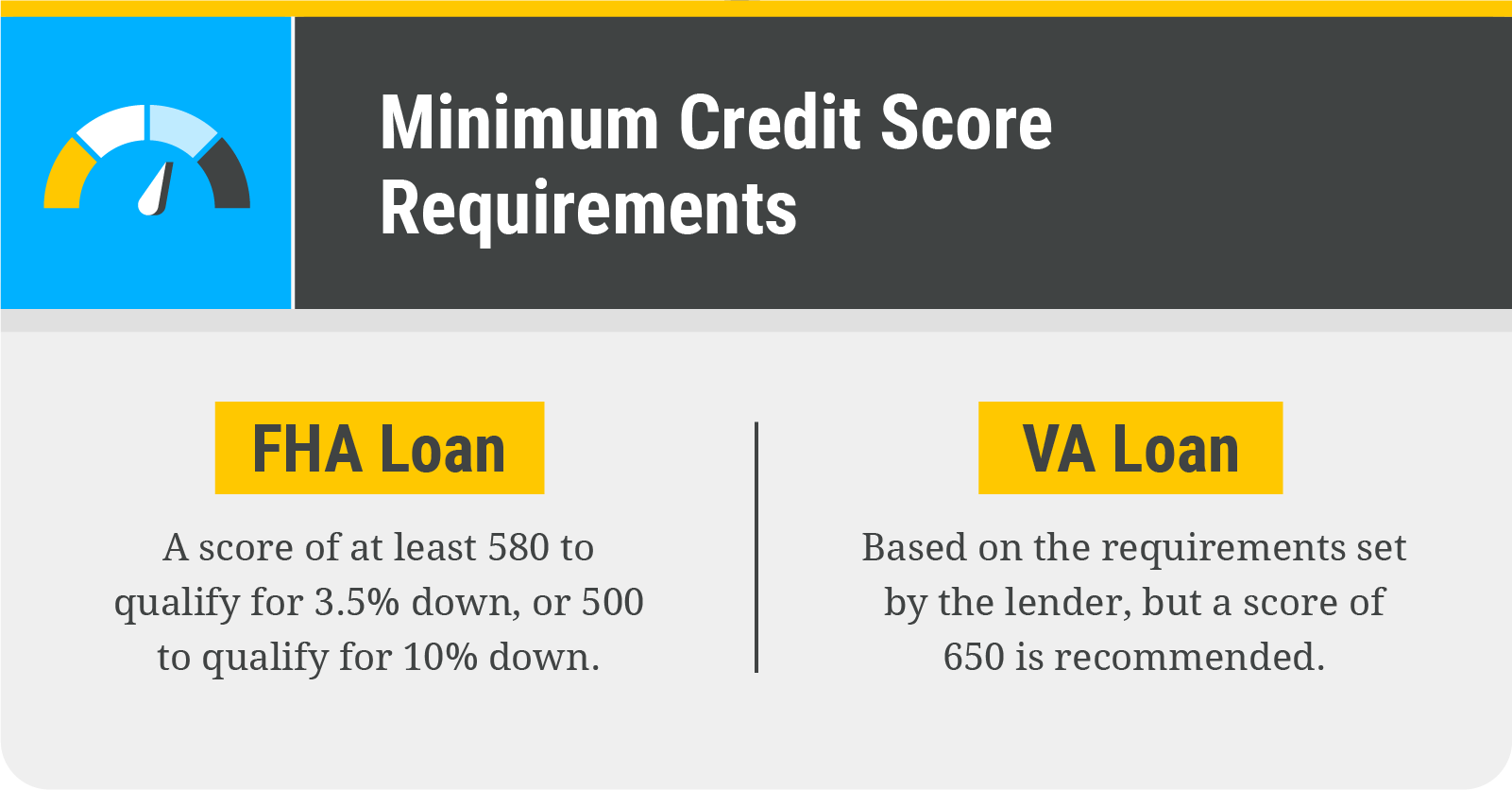

- Credit score: A credit history out of 620 or even more is frequently required to help you replace your possibility of acceptance.

- Loan-to-Worth (LTV) Ratio: Keeping a fair LTV ratio is recommended, particularly when you’re planning in order to move closing costs with the financing.

- Payment Records: Consistent fee records on the existing Va loan is actually encouraged, because shows economic balances, regardless if earnings confirmation isn’t really requisite.

Understand that these types of Va IRRRL direction provide required techniques you to lenders typically realize to streamline the process, whereas criteria (shielded next area) could be the required issues that need to be came across to help you qualify for an IRRRL.

Virtual assistant IRRRL Improve Refinance criteria

Meet up with Va IRRRL standards and you can qualify for an effective Virtual assistant Improve Re-finance (IRRRL), your current financial have to be good Virtual assistant home loan. People should also satisfy underwriting standards set by Company out of Veterans points.

- Present Virtual assistant Financing: The newest borrower need certainly to currently have a beneficial Virtual assistant-supported home loan.

- Occupancy: The home being refinanced must be the borrower’s number 1 house.

- Prompt Home loan repayments: New debtor need to have a commission https://paydayloanalabama.com/gantt/ records towards the established Virtual assistant mortgage, with no multiple late percentage in past times several days.

- Web Tangible Work with: The fresh re-finance need end in a tangible advantage to the new debtor, eg a reduced rate of interest, all the way down payment, otherwise a shift away from a varying-rate mortgage so you can a predetermined-rates financial.

- Resource Percentage: In most cases, a funding payment will become necessary, however it will likely be within the loan amount.

- No cash-Out: IRRRL is designed for speed and you can title refinancing only; it generally does not support bucks-aside refinancing.

- Zero Appraisal otherwise Borrowing Underwriting: In many cases, an appraisal or borrowing underwriting layered.

You’ll be able to check if you meet with the Virtual assistant IRRRL conditions by the examining together with your latest mortgage lender, or any other lender that’s signed up to-do Virtual assistant financing (some are).

Va IRRRL prices now

Virtual assistant IRRRL costs are some of the better home loan pricing into the business. As a consequence of support in the Service off Pros Factors, lenders could possibly offer exceedingly low interest during these fund.

Va IRRRL prices now,

The present starting rates to have a thirty-year Va IRRRL is actually % ( % APR), centered on our very own lender circle*, highlighting some of the finest Virtual assistant IRRRL prices now.

Definitely, Va refinance costs differ by customer. The speed can be highest or below mediocre depending on your loan size, credit rating, loan-to-well worth proportion, or any other points.

*Rates and you can yearly percentage cost to possess decide to try purposes only. Average prices guess 0% down and a beneficial 740 credit history. Come across our very own complete mortgage Va speed assumptions right here.

The Va IRRRL Improve Refinance performs

Like most home loan refinance, the fresh Va IRRRL system substitute your existing mortgage with a brand new loan. The brand new mortgage starts fresh at 31 otherwise 15 years, depending on hence loan identity you choose.

Just like the there is absolutely no income, a position, otherwise borrowing from the bank verification necessary, consumers have less documents to deal with. Therefore do not require an alternative Certification off Qualifications (COE), while the IRRRL can only just be studied to your a preexisting Va mortgage. So that the financial already understands you might be Va-eligible.